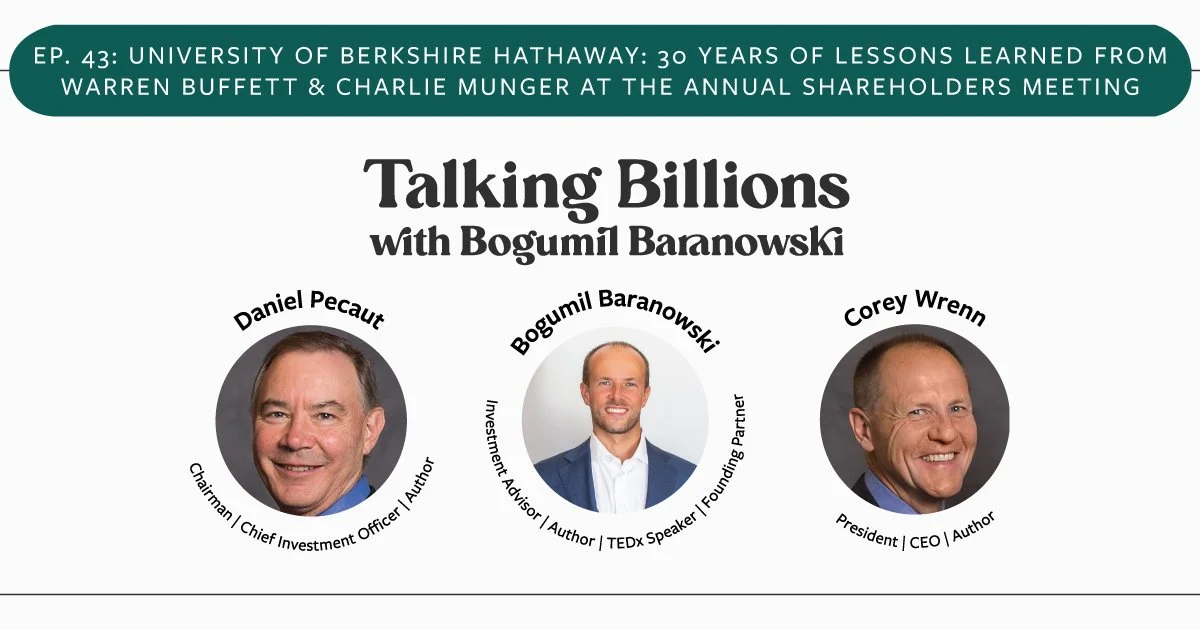

Episode 43: Daniel Pecaut and Corey Wrenn | University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders Meeting

Please enjoy the episode by clicking the “play” button above.

Alternatively, listen from your preferred platform here.

My guests are: Daniel Pecaut - Chairman | Chief Investment Officer | Author & Corey Wrenn - President | CEO | Author

Chairman and President of Pecaut & Company.

If you are a Berkshire and Buffett fan, this episode is for you. We’ll go on a trip back in time to the early days of Buffett’s Berkshire. Both my guests have been going to Berkshire’s Annual Meetings since the 1980s, and one of my guests actually worked for Buffett, and was checking tickets, and letting attendees in at the annual meetings. They have some incredible stories to share.

Daniel Pecaut is a Harvard graduate whose insights have been featured in the New York Times, Money Magazine, Grant's Interest Rate Observer, Outstanding Investor Digest, and the Omaha-World Herald.

He has worked in investing for 30+ years and is Chairman and Chief Investment Officer of a successful investment firm, Pecaut & Company.

For 9 years (1983-1992), Corey Wrenn was an internal auditor at Berkshire Hathaway.

Wrenn is now the President and CEO of the investment firm, Pecaut & Company.

Wrenn received his M.B.A from University of Nebraska at Omaha.

Today – we talked about everything from Dan’s grandfather’s tales of 1920s bull market, and the 1929 market crash, Corey’s years at Berkshire to lesson from almost 4 decades of Berkshire’s annual meetings, and more.

1. Dan shared his family history with stock market investing, while Corey discussed his involvement with Berkshire Hathaway.

2. My guests shared their memories of early Berkshire meetings and described what it was like to be a part of them.

3. We delved into the peculiar nature of an insurance company.

5. The history of Buffett's thoughts on inflation was discussed, considering its implications as a looming threat over the years.

6. Buffett and Munger's perspectives on making predictions.

7. The guests mentioned the valuable advice Buffett has for those starting out in life and investing, particularly addressing younger members of the audience at the annual meeting.

8. The guests discussed Buffett's stance on taxes, noting his commitment to paying what he owes while utilizing available tax benefits for Berkshire, such as deferred taxation and strategic sales triggering immediate tax consequences.

9. The guests highlighted the ethical standards upheld by Buffett, Munger, and Berkshire, which go beyond legal requirements and regulations, emphasizing their commitment to ethical behavior.

10. We concluded the conversation by discussing how my guests define success in their own lives, providing personal insights on the topic.

https://www.danielpecaut.com/university-of-berkshire-hathaway/

---- Crisis Investing: 100 Essays - My new book.

To get regular updates and bonus content, please sign-up for my substack: https://bogumilbaranowski.substack.com/

Follow me on Twitter: https://twitter.com/bogumil_nyc

Learn more about Bogumil Baranowski

NEVER INVESTMENT ADVICE.

IMPORTANT: As a reminder, the remarks in this interview represent the views, opinions, and experiences of the participants and are based upon information they believe to be reliable; however, neither my firm nor I have independently verified all such remarks. The content of this podcast is for general, informational purposes, and so are the opinions of a member of a registered investment adviser and guests of the show. This podcast does not constitute a recommendation to buy or sell any specific security or financial instruments or provide investment advice or service. Past performance is not indicative of future results.